INCREASING REPO RATE AND ITS IMPACT ON REAL-ESTATE PURCHASE

Interest rates in the finance sector are bound to rise in an off-cycle repo rate hike by RBI (Reserve Bank of India). The hike was quite unprecedented and has revolutionized Real Estate in Ahmedabad and everywhere in the nation. Inflation has been on the rise for quite a long time and rebounding in regional economic activity. While some are expecting this hike to support and also anchor inflation in parallel.

WHAT EXACTLY IS THE REPO RATE?

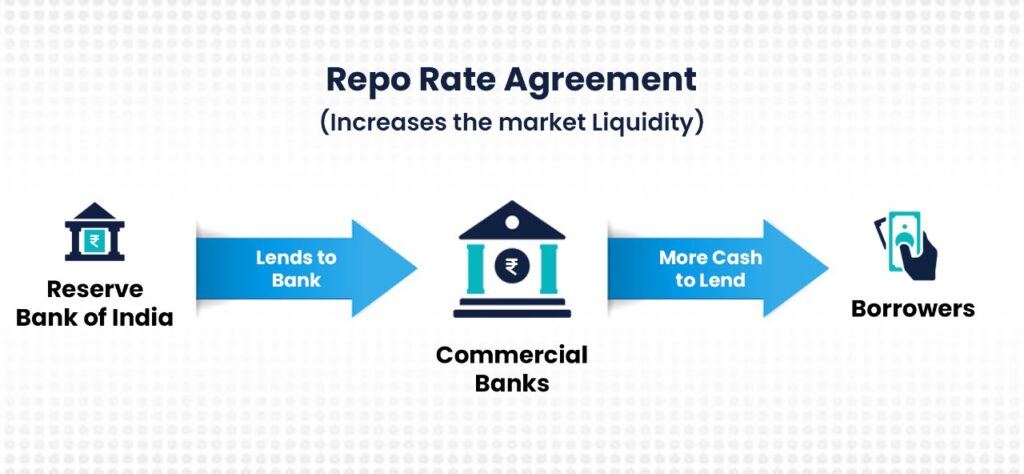

Repo stands for repurchasing option or agreement. People take loans from banks whenever required in a financial crunch situation and pay interest. Similarly, commercial banks also face a shortfall of funds, and they borrow money from the country’s apex bank, the RBI (Reserve Bank of India). The RBI lends money to the commercial banks in the same process but charges an interest rate on the principal amount. Repo rate is the interest rate at which RBI lends money to the commercial banks in India on behalf of Government securities.

NOW, WHAT IS THE REVERSE REPO RATE?

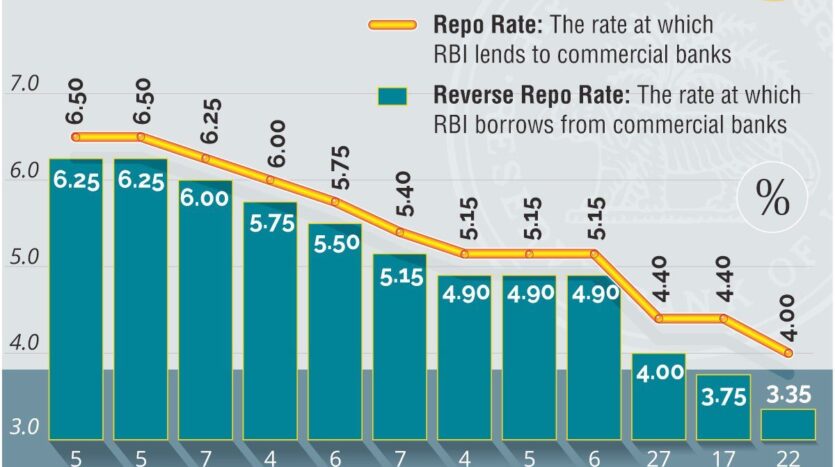

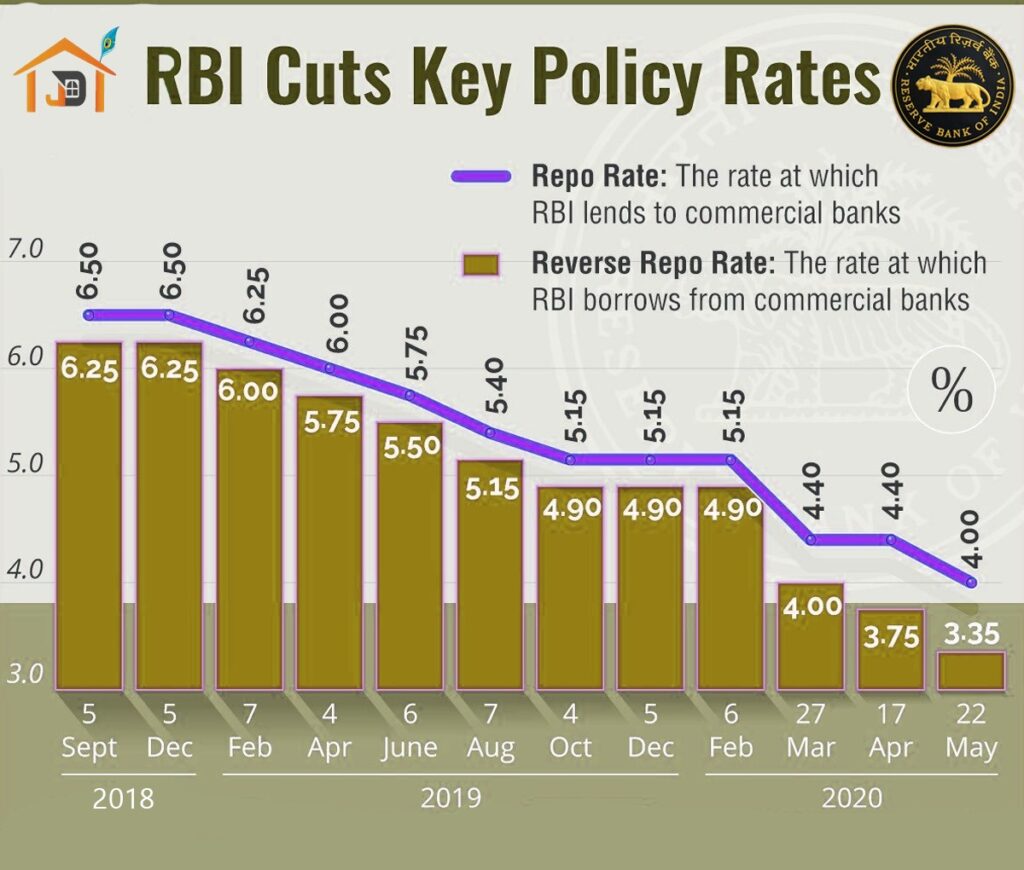

The reverse repo rate is the rate at which the commercial banks lend money to the Reserve bank of India on any shortfall of funds. The reverse repo rate is 3.35% in India. It is always lower than the Repo rate. It is used to manage cash flow in the economy. Mostly the transactions that happen here are via bonds.

It is also known as the Repurchase agreement of government securities.

HOW DOES THE REPO RATE AFFECT THE REAL ESTATE INDUSTRY?

For the first time in history, the Reserve Bank of India has increased the repo rate by almost 40 basis points to tackle inflation. This led to a hike in the real estate sector, and banks started increasing interest rates in lending and deposit schemes. The current repo rate is 4.40% which has been announced by the governor of RBI, Shaktikanta Das. He also said the repo rate would rise again in June by RBI. To make it easier to understand, a repo rate hike makes borrowing costlier in the economy.

For the first time in history, the Reserve Bank of India has increased the repo rate by almost 40 basis points to tackle inflation. This led to a hike in the real estate sector, and banks started increasing interest rates in lending and deposit schemes. The current repo rate is 4.40% which has been announced by the governor of RBI, Shaktikanta Das. He also said the repo rate would rise again in June by RBI. To make it easier to understand, a repo rate hike makes borrowing costlier in the economy.

All the loans against the property, such as the increase in home loans and loans on the property, will cost higher, and there is an inevitable increase in EMI.

On the other side, the continued job growth in the corporate sector will provide a cushion in the short term for the buying decisions.

AFFECT ON CONSTRUCTION RAW MATERIALS

The rising interest rates and inflationary trends in basic raw materials while construction is increasing day by day, including cement, steel, and labour cost, and add to the burden of the real estate sector in the year 2022. This hike in interest rates will impact overall acquisition costs for homebuyers and may dampen residential sales. These things happen only because of the increase in repo rates by RBI.

From the real estate point of view, the hike in repo rates is not worthful as there is a negative impact as home loan rates will hike immediately. After five years, we again made a robust comeback in residential sales and launches in the last couple of quarters due to the affordability of synergy.

Repo rate hike signals are an imminent end to an all-time low-interest regime, one of the significant drivers behind home sales since the pandemic hits the economy. Moreover, the sudden rise in repo rate will automatically increase the prices of raw materials such as cement, steel, and labour cost and add a burden to the real estate sector. Ultimately, the interest rates will impact the overall acquisition cost for home buyers and the possibility of a general price hike on the land purchase or construction of a new building.

AFFECT ON RESIDENTIAL DEMAND

The next two months will be a very tough situation for the real estate industry as developers will need to access demand dynamics that contribute overall home buying experience, giving home buyers last-mile benefits. The RBI announcement of increasing the repo rate will make the real estate industry nervous.

Historically low interest rates are better than high-interest rates as it has been a major contributor to a sharp increase in residential sales since the beginning of the covid-19 pandemic in the year 2020.

However, interest rates are higher now and the prices of land and houses are also increasing day by day which would take away the affordability for the home buyers.

Inflation rates in India have been beyond the RBI’s upper band of tolerance, hence the rationale of the move makes sense that home loans would get impacted by a hike in repo rates.

Conclusion

Hence, the interest rates are quite higher than they ever used to be. The prices of commercial spaces and flats in Ahmedabad are increasing day by day. This is a sign of danger for the affordability in loans, EMI, residential, and commercial sectors. The Indian inflation rates have already crossed the tolerance level of RBI. There are going to be much more impacts of the same than what we are witnessing today.